Rumored Buzz on Pvm Accounting

Table of Contents6 Simple Techniques For Pvm AccountingPvm Accounting Things To Know Before You BuyOur Pvm Accounting DiariesThe smart Trick of Pvm Accounting That Nobody is DiscussingPvm Accounting - An OverviewIndicators on Pvm Accounting You Need To Know

Oversee and take care of the production and approval of all project-related invoicings to consumers to foster great communication and stay clear of problems. financial reports. Ensure that proper records and documentation are submitted to and are upgraded with the IRS. Guarantee that the bookkeeping procedure conforms with the regulation. Apply called for building accountancy standards and procedures to the recording and reporting of building task.Interact with different funding agencies (i.e. Title Company, Escrow Business) pertaining to the pay application procedure and requirements required for settlement. Aid with implementing and maintaining inner economic controls and procedures.

The above statements are intended to describe the basic nature and degree of job being done by people designated to this classification. They are not to be understood as an extensive listing of obligations, tasks, and skills required. Employees might be called for to carry out responsibilities beyond their normal responsibilities once in a while, as needed.

A Biased View of Pvm Accounting

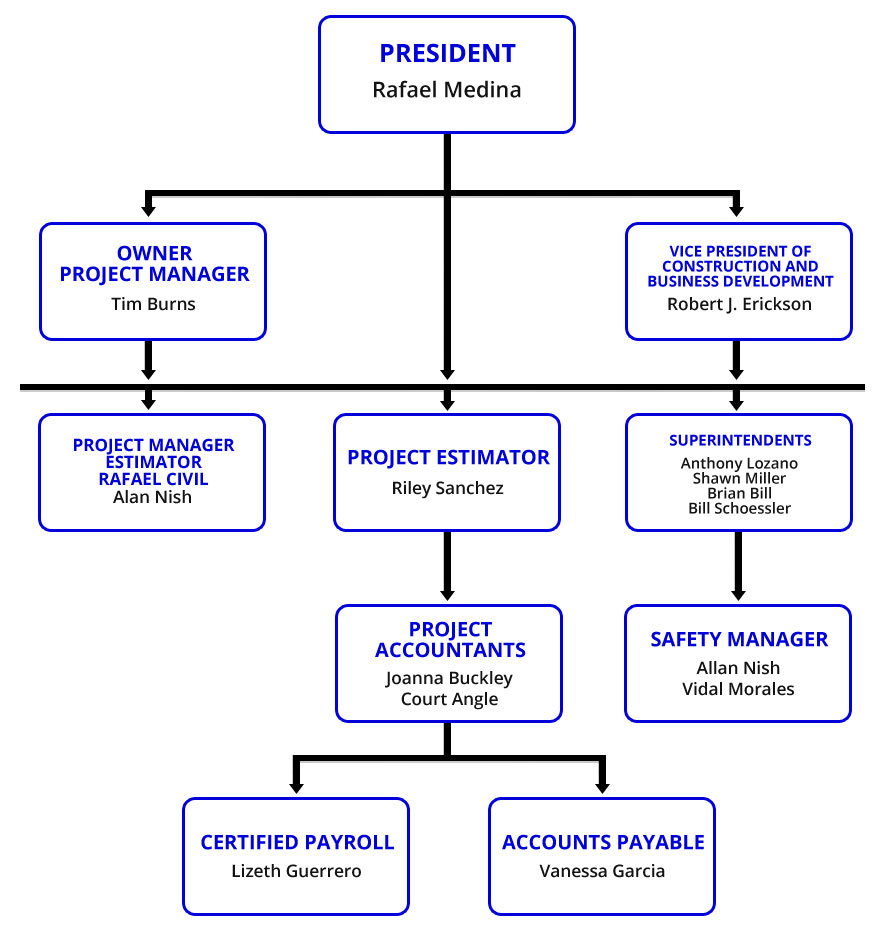

Accel is seeking a Building Accounting professional for the Chicago Office. The Building and construction Accounting professional executes a selection of accounting, insurance policy conformity, and project administration.

Principal tasks include, yet are not restricted to, handling all accounting functions of the business in a timely and accurate way and supplying records and timetables to the company's CPA Firm in the preparation of all monetary statements. Makes sure that all audit treatments and features are taken care of precisely. Liable for all economic documents, pay-roll, banking and everyday operation of the bookkeeping function.

Prepares bi-weekly trial balance reports. Functions with Project Managers to prepare and upload all month-to-month billings. Processes and problems all accounts payable and subcontractor payments. Generates month-to-month wrap-ups for Employees Settlement and General Responsibility insurance coverage premiums. Generates month-to-month Work Expense to Date reports and collaborating with PMs to integrate with Task Managers' allocate each task.

Getting The Pvm Accounting To Work

Effectiveness in Sage 300 Building and Realty (formerly Sage Timberline Office) and Procore building monitoring software a plus. https://www.intensedebate.com/profiles/leonelcenteno. Have to likewise excel in other computer system software application systems for the preparation of records, spread sheets and other accounting evaluation that may be needed by monitoring. construction accounting. Need to have solid organizational skills and capability to focus on

They are the economic custodians who guarantee that building tasks continue to be on budget plan, follow tax obligation regulations, and maintain monetary transparency. Building and construction accounting professionals are not simply number crunchers; they are strategic partners in the construction process. Their main function is to handle the monetary elements of construction tasks, making sure that sources are alloted successfully and financial risks are minimized.

The Basic Principles Of Pvm Accounting

They work closely with task supervisors to develop and check spending plans, track costs, and forecast economic needs. By preserving a tight grasp on job funds, accounting professionals assist avoid overspending and financial obstacles. Budgeting is a foundation of successful construction tasks, and building accountants contribute in this regard. They develop detailed spending plans that encompass all project expenses, from products and labor to permits and insurance.

Building and construction accounting professionals are fluent in these regulations and guarantee that the job complies with all tax demands. To stand out in the function of a find out here now construction accountant, people require a strong instructional structure in accounting and finance.

Additionally, qualifications such as Qualified Public Accounting Professional (CPA) or Qualified Construction Industry Financial Expert (CCIFP) are highly regarded in the sector. Building projects usually entail tight deadlines, transforming policies, and unexpected costs.

Not known Details About Pvm Accounting

Specialist certifications like certified public accountant or CCIFP are additionally extremely suggested to demonstrate know-how in building and construction audit. Ans: Building and construction accountants create and check spending plans, recognizing cost-saving chances and guaranteeing that the project remains within budget plan. They likewise track expenses and projection monetary needs to protect against overspending. Ans: Yes, building and construction accountants take care of tax conformity for building projects.

Intro to Building And Construction Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections among several economic alternatives, like bidding process on one project over one more, picking financing for products or equipment, or setting a task's profit margin. Building is an infamously volatile industry with a high failing rate, slow time to repayment, and irregular cash money flow.

Manufacturing includes duplicated procedures with quickly recognizable costs. Production calls for different processes, products, and tools with varying expenses. Each task takes area in a new place with differing website conditions and distinct challenges.

The Greatest Guide To Pvm Accounting

Long-lasting relationships with vendors reduce settlements and enhance performance. Irregular. Constant use various specialized contractors and providers impacts effectiveness and cash flow. No retainage. Payment arrives completely or with routine settlements for the complete agreement quantity. Retainage. Some part of repayment may be withheld until task conclusion also when the professional's work is finished.

Routine manufacturing and temporary contracts bring about workable capital cycles. Uneven. Retainage, sluggish payments, and high ahead of time costs bring about long, uneven capital cycles - construction accounting. While traditional makers have the advantage of controlled environments and enhanced production processes, construction business must constantly adjust to each new task. Even rather repeatable jobs call for modifications as a result of site problems and various other elements.